In the realm of inheritance law in Spain, proper documentation holds paramount importance. When it comes to navigating the complexities of transferring assets and properties to heirs, understanding the nuances of documentation for inheritances in Spain is crucial. In this comprehensive guide, we will delve into the key requirements and procedures that individuals need to be acquainted with to ensure a seamless transition of assets and properties to their rightful beneficiaries.

Understanding Spanish Inheritance Law

Documentation for inheritances in Spain begins with a solid grasp of the legal framework governing the process. Spanish inheritance law is founded upon principles that dictate how assets are distributed among heirs. Understanding these principles, including the concept of forced heirship and legitimate portions, lays the foundation for comprehending the documentation requirements in detail.

Documentation Checklist for Inheritances in Spain

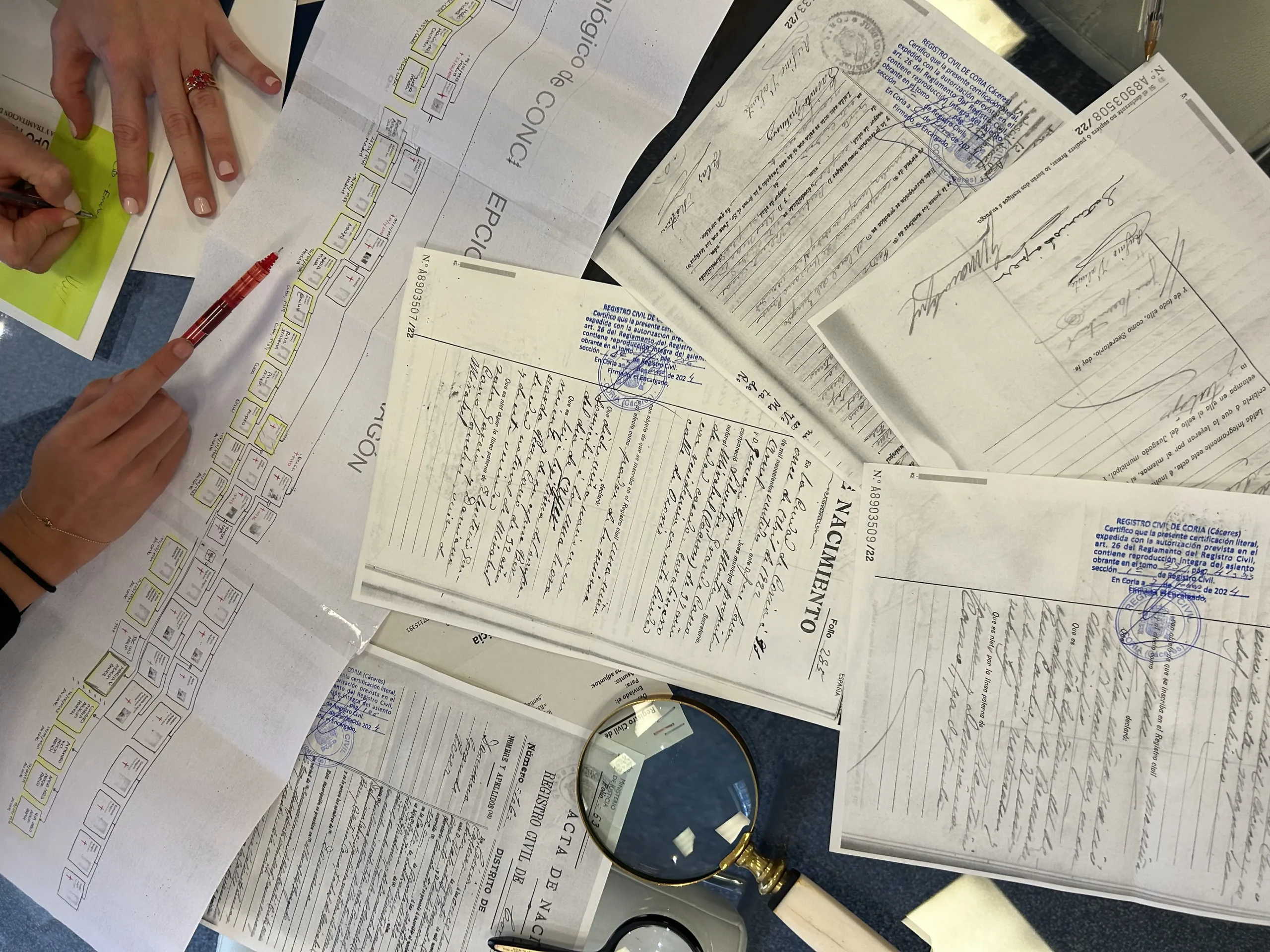

At the core of the inheritance process in Spain lies a meticulous documentation checklist. This checklist encompasses a myriad of documents, each playing a crucial role in the inheritance proceedings. Among these documents are death certificates, wills, property deeds, identification documents, and tax-related paperwork. Ensuring the completeness and accuracy of these documents is essential for initiating and completing the inheritance process smoothly.

Procedures for Inheritance Settlement for inheritances in Spain

Once the documentation is in order, navigating the procedures for inheritance settlement becomes the next step. In Spain, the process typically involves probate proceedings, the appointment of an executor or administrator, inventory of assets, valuation of properties, and ultimately, the distribution of inheritance among beneficiaries. Each of these steps requires adherence to specific procedures outlined by Spanish law.

Tax Implications and Declarations

One aspect of documentation for inheritances in Spain that cannot be overlooked is the tax implications associated with inheriting assets. Inheritance tax, gift tax, and capital gains tax are among the taxes that heirs may be subject to. Understanding the tax implications and fulfilling tax obligations through proper declarations to the Spanish tax authorities is integral to the inheritance process.

Challenges and Pitfalls

Despite efforts to adhere to documentation requirements and procedures, challenges and pitfalls may arise during the inheritance process in Spain. Conflicting wills, disputes among heirs, complex property arrangements, and bureaucratic hurdles are some of the common challenges individuals may encounter. Navigating through these challenges requires diligence, patience, and oftentimes, professional legal assistance.

Legal Assistance and Resources

Given the intricacies involved in documentation for inheritances in Spain, seeking legal assistance from qualified experts is highly advisable. Lawyers specializing in Spanish inheritance law can provide invaluable guidance and support throughout the inheritance process. Additionally, notaries and government agencies can offer resources and assistance to individuals navigating the complexities of inheritance documentation.

Conclusion

In conclusion, documentation for inheritances in Spain encompasses a wide array of requirements and procedures that individuals must navigate to ensure a smooth transition of assets and properties to their heirs. By understanding Spanish inheritance law, adhering to documentation checklists, following procedures for inheritance settlement, addressing tax implications, and seeking legal assistance when needed, individuals can effectively navigate the inheritance process in Spain.

Grupo Hereda covers all the initial expenses

Grupo Hereda is a national and international law firm with over twenty years of experience. We cover all initial expenses. Don’t regect your inheritance due to fear of initial costs; Grupo Hereda can find a solution for you. If you are aware of a vacant inheritance, do not hesitate to contact us.

You can call us at (+34) 915 48 75 50 or send us an email at info@grupohereda.com